Owen Sound Council Passes 5.2% City Budget Increase for 2026

While the City levy rose 5.2%, Owen Sound residents will see a 4.72% property tax hike in 2026 with County and education levies factored in. Here’s what that means for households and services.

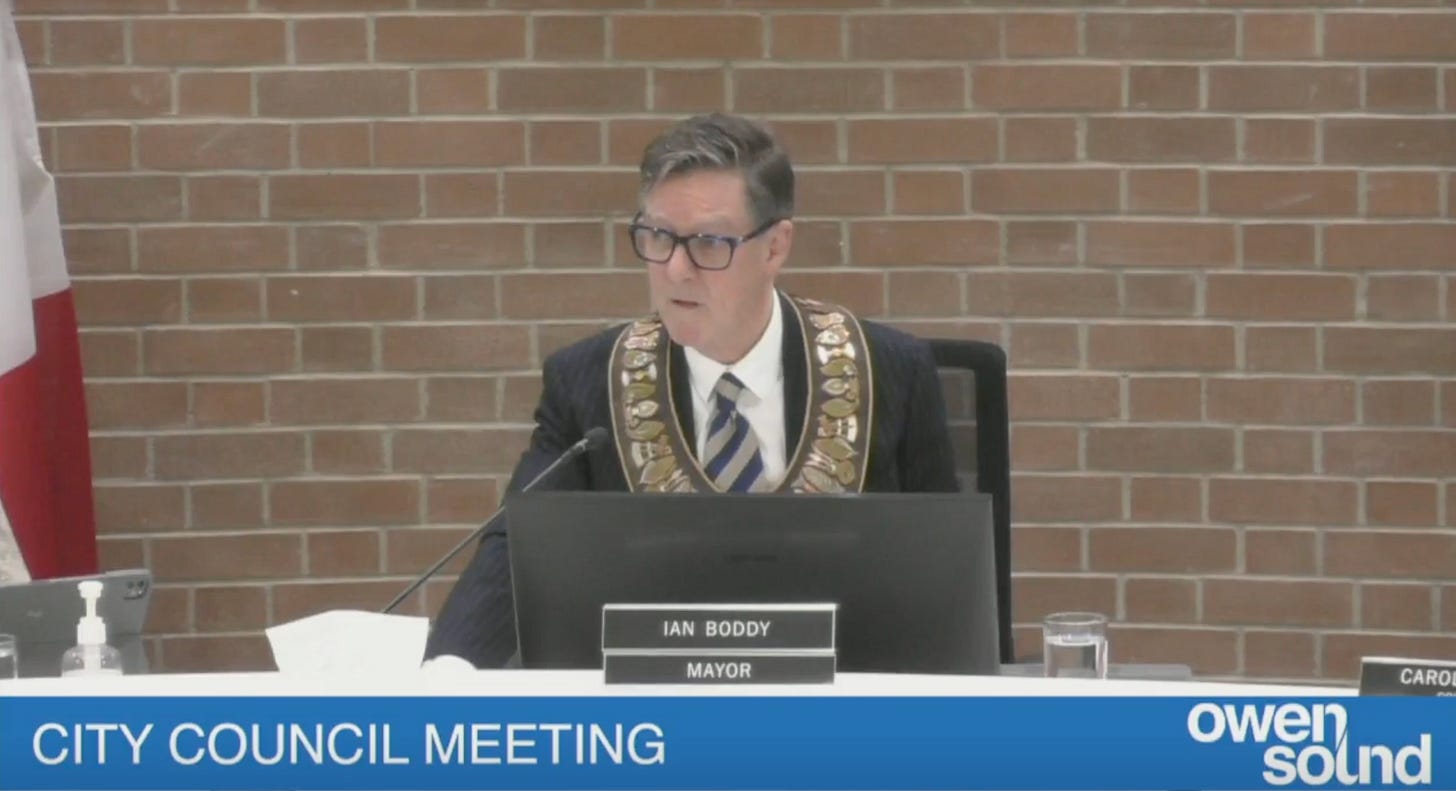

Owen Sound residents will see a 4.72% increase on their property tax bills in 2026 after City Council allowed the proposed Mayor’s Budget to pass without amendments on January 16.

The City’s 2026 operating budget includes a total tax levy of …

Keep reading with a 7-day free trial

Subscribe to The Owen Sound Current to keep reading this post and get 7 days of free access to the full post archives.