Column: Understanding RESPs and the Power of Government Grants

A Registered Education Savings Plan helps families save for post-secondary costs with tax-sheltered growth and government grants. Here's how.

COMMUNITY CONTRIBUTION

by Lesley Etchegary-Nicholson

In this column, we are making progress on our journey to learn how to save our money more effectively. Last month, we covered the recent introduction of the First Homeowner Savings Account and the huge difference it can make for those dreaming of their first home. We outlined the power of tax deductions and tax-sheltered growth.

Tax is by far the number one destroyer of wealth, so you will notice this as a recurring theme over the next few articles. I try to explain these types of accounts in understandable terms, outlining the potential tax deductions, tax-sheltering and government grants.

This month, we are going to look at educating our children and grandchildren.

Every parent hopes that their child will be able to follow their own dreams, go to university, college or trade school. Starting a plan to save for those dreams early is key; the Registered Education Savings Plan (RESP) can supercharge your child’s chances of pursuing their dreams.

Contributions to the plan are made, a government education grant (CESG), is directed into the plan and your savings grow sheltered from taxation. Once your child is enrolled in full-time post-secondary education, funds are withdrawn (in a tax-favoured status) to pay for everything from tuition to residency costs or a vehicle.

As with all savings programs structured by the government and administered by financial institutions, there is fine print and red tape. The benefits of this savings plan are definitely worth the paperwork, and once set up, it runs like clockwork.

For most folks, where parents are The Subscriber (or donor), all you need is your photo ID and your child’s (The Beneficiary) birth certificate & Social Insurance Number card. These plans are available at almost every bank.

To understand the importance of setting up an RESP early, let’s examine some statistics from a 2021 study on the outcomes over time for students and apprentices. Studies are tracked by participation in the Canada Education Savings Grant (CESG), a 20% bonus that the government adds to your contributions of up to $2,500 per year.

In 2019, 43% of Ontario Post-Secondary Students (PSEs) had an RESP open and had received the Canada Education Savings Grant.

At the national level, the average RESP value for beneficiaries born in 2003 is $25,400. RESP values are made up of your contributions, government grant (CESG) and tax-sheltered growth.

Participation in Post-Secondary Education increases by a whopping 84% when an RESP is established and the CESG is received.

Over the past decade, the share of Post-Secondary students who had RESPs funded and were receiving government grant monies increased by 73%.

If you start contributing $50 per month to an RESP for a 5-year-old child, by the time they finish high school at age 17, that young adult will have almost $11,000 to help fund their post-secondary education costs. This reasonably assumes that you receive the 20% government grant (CESG), and a 3.50% rate of return.

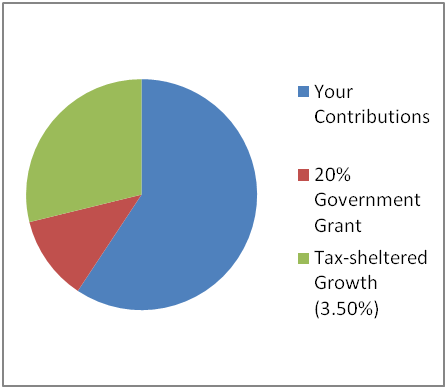

Let’s fast-forward to your child at age 18, who has enrolled full-time in post-secondary education. The tax savings continue as you withdraw funds. The chart below shows the breakdown of the $11,000 RESP value at the end of 12 years.

Your monthly $50 contributions make up 60% of the plan value; the remaining 40% comes from the Canada Education Savings Grant (CESG) and the tax-sheltered growth inside the plan.

If you are interested in learning more about setting up an RESP, contact your bank or financial institution. They can prepare all of the paperwork and give you more personalized advice based on your own circumstances.

Registered Education Savings Plans (RESPs) are an amazing opportunity to create a living legacy by providing the next generation with solid stepping stones.

Contributor Lesley Etchegary-Nicholson has retired from a 30+ year career in the investment and financial services industry.

Thank you to sponsors of The Owen Sound Current Writers’ Fund, who make these community contributions possible. Contributions from the community do not necessarily reflect the opinions or beliefs of The Owen Sound Current and its editor or publisher.